|

|

|

|---|

|

|

|

|---|---|---|

|

|

|

|

|

|

|---|---|---|

|

|

|

|

Bankruptcy Attorney Columbus Indiana: Navigating Your Financial Future

Facing financial hardship can be overwhelming, but hiring a bankruptcy attorney in Columbus, Indiana can provide the expertise needed to navigate these challenges. This guide explores the roles and benefits of these legal professionals, providing clarity in times of uncertainty.

Understanding Bankruptcy Law

Bankruptcy law is designed to help individuals and businesses regain financial stability by eliminating or restructuring debts. In Columbus, Indiana, a bankruptcy attorney can guide you through this complex legal process.

The Role of a Bankruptcy Attorney

A bankruptcy attorney provides critical services such as assessing your financial situation, advising on the best type of bankruptcy to file, preparing necessary documents, and representing you in court.

Benefits of Hiring a Local Bankruptcy Attorney

- Expertise in Local Laws: Understanding state-specific regulations ensures a smoother process.

- Personalized Advice: Local attorneys can provide tailored advice based on your unique financial situation.

- Efficient Process: Familiarity with local court procedures can expedite the bankruptcy process.

For a broader perspective, you might want to explore how bankruptcy lawyers in Oklahoma handle similar cases.

Steps in Filing for Bankruptcy

- Consultation: Initial meeting to discuss financial status and options.

- Document Preparation: Gathering and filing necessary paperwork.

- Court Proceedings: Representation during hearings and meetings with creditors.

- Debt Discharge: Completion of the bankruptcy process and discharge of eligible debts.

Each step requires careful attention to detail, highlighting the importance of professional legal guidance.

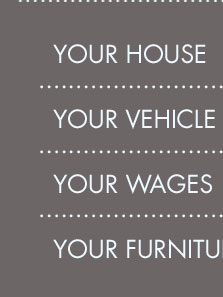

Common Misconceptions About Bankruptcy

Many people fear bankruptcy due to misunderstandings. It's crucial to dispel myths such as permanent credit damage or loss of all assets. A knowledgeable attorney can provide clarity and peace of mind.

FAQs About Bankruptcy in Columbus, Indiana

What is the difference between Chapter 7 and Chapter 13 bankruptcy?

Chapter 7 involves liquidating non-exempt assets to pay creditors, while Chapter 13 allows for a repayment plan over three to five years.

How long does the bankruptcy process take?

Chapter 7 typically takes 4-6 months, whereas Chapter 13 can last 3-5 years, depending on the repayment plan.

Can I keep my house and car after filing for bankruptcy?

Yes, depending on the exemptions available in Indiana and the type of bankruptcy filed. Chapter 13, in particular, is designed to help you keep your assets.

Will bankruptcy affect my future credit?

Bankruptcy can initially impact your credit score, but it also offers a chance to rebuild and improve your financial standing over time.

By consulting with an expert, such as a bankruptcy lawyer in Rhode Island, you can learn about diverse approaches to rebuilding credit post-bankruptcy.

Find the best bankruptcy attorney serving Columbus. Compare top Indiana lawyers' fees, client reviews, lawyer rating, case results, education, awards, ...

Zuckerberg, P.C. Call us today for a FREE Debt Consultation. Columbus Office Address. 725 3rd Street. Columbus, Indiana 47201. United States (US).

If you live in Columbus, Indiana, or anywhere else in Bartholomew County, and would like to know whether bankruptcy is the right solution to your financial ...

![]()